Spot cargoes likely to increase further: Petronet LNG

2-Sep-2011Petronet LNG , the biggest beneficiary of the increasingly gas-starved Indian market, had reported a massive 131.5% jump in its first quarter FY12. Petronet enjoys the first mover advantage in this gas space with its 10 MMTPA LNG terminal at Dahej.

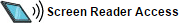

The company is planning to expand its Dahej capacity by 5 MMTPA and is also setting up a greenfield LNG terminal of 5 MMTPA in Kochi. A Balyan, chief executive officer and managing director of Petronet LNG, in an exclusive interview with CNBC-TV18ís Latha Venkatesh and Ekta Batra, said that the company has done 100% capacity utilisation of its Dahej terminal.

"Our spot cargoes of liquified natural gas are likely to increase further," added Balyan.

Below is the edited transcript of the interview. Also watch the accompanying video.

Q: Q1FY12 was very strong in terms of volumes which were up 40% Y-O-Y and 6% on a sequential basis. What can we expect from you in terms of a volume performance for Q2?

A: As far as the gas demand in our country is concerned, the long term perspective could set as very big large numbers. Since the availability of the domestic gas is limited, the growth is coming from LNG. The trends for the last two-three quarters have been increasing and in the last quarter, we did 100% capacity utilisation of our terminal, which is operating at Dahej by going beyond 10 million tonne capacity.

We expect that the trends are going to be more or less similar and will be of the same order. While we have about 7.5 million tonne confirmed, we have long term contract with Qatar and a mid-term contract which will contribute 1.5 million tonne, so totaling around 9 million. Our spot cargoes of liquified natural gas are likely to increase further.

Q: There are a lot of people who expect your FY12 re-gasification volumes to be about 10.2 million tonne. Is that doable or is there another upside to that given Q1 looks so good?

A: We are confident that the trend is following some of the other projections that we had earlier discussed and we are sure that we would be able to operate above 10 million tonne capacity for the complete year. The 100% capacity utilisation may go beyond that as well because we see the strong requirement for gas in all sectors.

Q: What is the update on a tie-up with Gazprom in June 2011?

A: We are in negotiation with Gazprom. We have exchanged our documentation. We have had 2-3 meetings and we have progressed on that. There are two key factors that we are addressing, one is time-line of supplies and second is pricing.

Russia is going in a big way in LNG and we feel that in the next 8 to 10 years time, they could be producing somewhere around 35-40 million tonne of LNG. They see India as a big market so they have a very focused approach to India. We hope in coming months we should be able to come to some agreement.

Q: Any more supply contracts beside Gazprom that you are currently in negotiations with or any sort of quantum that we could expect in FY12?

A: We are in discussion with Qatar also. Qatar has added huge quantities, capacities of their LNG. They can produce upto 77 million tonne. We are also in negotiation with RasGas particularly and they have agreed to supply to us.

We are in discussion again regarding the pricing, which is very important from the Indian market point of view. We have progressed and we hope that in coming months, we could come to a conclusion with RasGas on additional quantities of gas for India.

Video Link

The company is planning to expand its Dahej capacity by 5 MMTPA and is also setting up a greenfield LNG terminal of 5 MMTPA in Kochi. A Balyan, chief executive officer and managing director of Petronet LNG, in an exclusive interview with CNBC-TV18ís Latha Venkatesh and Ekta Batra, said that the company has done 100% capacity utilisation of its Dahej terminal.

"Our spot cargoes of liquified natural gas are likely to increase further," added Balyan.

Below is the edited transcript of the interview. Also watch the accompanying video.

Q: Q1FY12 was very strong in terms of volumes which were up 40% Y-O-Y and 6% on a sequential basis. What can we expect from you in terms of a volume performance for Q2?

A: As far as the gas demand in our country is concerned, the long term perspective could set as very big large numbers. Since the availability of the domestic gas is limited, the growth is coming from LNG. The trends for the last two-three quarters have been increasing and in the last quarter, we did 100% capacity utilisation of our terminal, which is operating at Dahej by going beyond 10 million tonne capacity.

We expect that the trends are going to be more or less similar and will be of the same order. While we have about 7.5 million tonne confirmed, we have long term contract with Qatar and a mid-term contract which will contribute 1.5 million tonne, so totaling around 9 million. Our spot cargoes of liquified natural gas are likely to increase further.

Q: There are a lot of people who expect your FY12 re-gasification volumes to be about 10.2 million tonne. Is that doable or is there another upside to that given Q1 looks so good?

A: We are confident that the trend is following some of the other projections that we had earlier discussed and we are sure that we would be able to operate above 10 million tonne capacity for the complete year. The 100% capacity utilisation may go beyond that as well because we see the strong requirement for gas in all sectors.

Q: What is the update on a tie-up with Gazprom in June 2011?

A: We are in negotiation with Gazprom. We have exchanged our documentation. We have had 2-3 meetings and we have progressed on that. There are two key factors that we are addressing, one is time-line of supplies and second is pricing.

Russia is going in a big way in LNG and we feel that in the next 8 to 10 years time, they could be producing somewhere around 35-40 million tonne of LNG. They see India as a big market so they have a very focused approach to India. We hope in coming months we should be able to come to some agreement.

Q: Any more supply contracts beside Gazprom that you are currently in negotiations with or any sort of quantum that we could expect in FY12?

A: We are in discussion with Qatar also. Qatar has added huge quantities, capacities of their LNG. They can produce upto 77 million tonne. We are also in negotiation with RasGas particularly and they have agreed to supply to us.

We are in discussion again regarding the pricing, which is very important from the Indian market point of view. We have progressed and we hope that in coming months, we could come to a conclusion with RasGas on additional quantities of gas for India.

Video Link

Source: Aug 26, 2011 CNBC-TV18

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country