Expect declining trend in LNG prices: CEO & MD

4-Sep-2012Dr. A Balyan CEO & MD of Petronet LNG said the pact signed between GAIL and Spain's Gas Natural Fenosa (GNF) will ensure good capacity utilisation for their Dahej terminal. According to him, most of the supply is likely to come to the terminal and as they are expanding capacity at the terminal, it would provide good returns to the company.

Balyan also feels that LNG prices would come down further and expects to see a declining trend in prices for the long as well as short-term.

Here is the edited transcript of the interview on CNBC-TV18.

Q: On August 31 GAIL signed an LNG Supply Pact with Spain's Gas Natural Fenosa (GNF) and it was a sizable amount. GNF will ensure a total supply of 3 bcm of LNG to GAIL over the next three years. That's a good bit of business coming your way. Does it increase your revenue forecast for the current and next year?

A: I think this is a good contract which GAIL has signed with Gas Natural and most of the gas is likely to come at our Dahej terminal. It would ensure that our capacity utilisation would be pretty good actually. We had been operating at around 100% capacity otherwise also. For the long-term I think we will have an assured supply.

Also while we are expanding our capacity at Dahej and we hope by 2013-14 when our second jetty would be operational we might be able to go beyond the 10 million tonne capacity with the existing facility. I think in the long-term this would help us move higher volumes and that would mean good returns for Petronet.

Q: In which terminal are you expecting this cargo to come at, will it be Dahej, Kochi or could it go to Dabhole as well?

A: I think the larger volumes should come at Dahej. Some volumes can certainly go to Dabhole which GAIL is trying to commission but, it is going to take time from the capacity point of view, from through put and from connectivity point of view I think larger volumes will certainly come to Dahej.

Q: We have seen a substantial drop in LNG prices and there are reports that since the prices are down to USD 10-10.5, capacity utilization has actually improved over Q1. What are you currently operating at in terms of the quarter to date average?

A: In the last month we have operated over 100% capacity. I think from the volumes and demand-supply point of view we are very happy with the present situation. As far as pricing is concerned, we have seen the spot prices coming down sharply from USD 15-16 mmBtu to almost about USD 10.5-11, which is good. In my opinion, they should come down further.

It should come to something around pre-Fukushima level, that was about USD 9.5-10. But in the long-term contracts we are not seeing such similar sharp declining trend. We believe that a similar trend should come. But I think from the capacities that are built up for LNG supply of the world, the availability of LNG and from the demand point of view also I think we should see some declining trend in the prices for long-term and short-term as well.

Q: What are the current long-term trends and how much may they dip?

A: We are negotiating with several potential suppliers for long-term volumes for our enhanced capacity at Dahej, also for Kochi and also considering that our third Gangavaram terminal would come up. The producers generally try to link it with crude oil and they expect somewhere around 14% of the linkage with crude, which in our opinion is still higher. We think that in time to come the long-term prices should also soften.

Q: On the ADB stake what's the progress? GAIL I think has been ruled out. You are in negotiations with Qatar at this point?

A: I am not aware of exactly what the board has said but I think out of the four, three promoter companies have taken review of their decision and have communicated to the ADB that they could go ahead with their stake sale to a strategic partner which should fit into the overall premise and working of the company without changing its character. I am sure GAIL would also do the same thing. It's a matter of discussion and time perhaps.

Q: You are in discussions with Qatar at this point. It would also help you in terms of long-term sourcing. I understand there are some differences over the prices that they are asking. Petronet I believe wants a slightly lower price. Are you in those discussions at this point?

A: As far as ADB’s stake is concerned, we have actually no role to play. It is the ADB which has to negotiate and work out as per the given process. But, we are negotiating with RasGas for long-term supply for quite sometime and we have moved ahead substantially on that.

I think we have been emphasizing on the special characters of the Indian markets which needs to be recognized. It needs to be seen differently than any other market in the Asian region. It's a long-term perspective that needs to be taken for India. We are trying to emphasize on the pricing to RasGas and we are in discussion with them.

Q: What might be the margins this year? Would you see them improve because of the fallen gas prices?

A: I think our major revenues come from regasification charges and the services we provide. Over 90% of our throughput is on the backpack for the regas services, but a very small amount of that comes from this thing. With the spot prices coming down, there is a likelihood of better margins, but all those things again are sold back to back.

I won't say a major difference, but yes, there is a possibility of better margins with the spot cargos which come and which are sold for a small time variation and requirements of the consumer.

Q: Even Marubeni is ending in 2013. What's the current trend looking like for long-term supplies? The people of course are asking for 14% on crude, but do you think it could come down to say 10-11%?

A: I won't really see that 10-11% will be a very good situation for India, but certainly around 12.5-13% would be more realistic considering the prevailing situation in the world in terms of LNG availability and the demand point of view and considering that the larger demand centres are in Asia, India and China.

I think that would be a very realistic price regime and we are proposing that the prices should soften. We also need to be very cautious because of this volatility. When we close these deals I think we will take some more time to really look for little more softening of the prices.

Balyan also feels that LNG prices would come down further and expects to see a declining trend in prices for the long as well as short-term.

Here is the edited transcript of the interview on CNBC-TV18.

Q: On August 31 GAIL signed an LNG Supply Pact with Spain's Gas Natural Fenosa (GNF) and it was a sizable amount. GNF will ensure a total supply of 3 bcm of LNG to GAIL over the next three years. That's a good bit of business coming your way. Does it increase your revenue forecast for the current and next year?

A: I think this is a good contract which GAIL has signed with Gas Natural and most of the gas is likely to come at our Dahej terminal. It would ensure that our capacity utilisation would be pretty good actually. We had been operating at around 100% capacity otherwise also. For the long-term I think we will have an assured supply.

Also while we are expanding our capacity at Dahej and we hope by 2013-14 when our second jetty would be operational we might be able to go beyond the 10 million tonne capacity with the existing facility. I think in the long-term this would help us move higher volumes and that would mean good returns for Petronet.

Q: In which terminal are you expecting this cargo to come at, will it be Dahej, Kochi or could it go to Dabhole as well?

A: I think the larger volumes should come at Dahej. Some volumes can certainly go to Dabhole which GAIL is trying to commission but, it is going to take time from the capacity point of view, from through put and from connectivity point of view I think larger volumes will certainly come to Dahej.

Q: We have seen a substantial drop in LNG prices and there are reports that since the prices are down to USD 10-10.5, capacity utilization has actually improved over Q1. What are you currently operating at in terms of the quarter to date average?

A: In the last month we have operated over 100% capacity. I think from the volumes and demand-supply point of view we are very happy with the present situation. As far as pricing is concerned, we have seen the spot prices coming down sharply from USD 15-16 mmBtu to almost about USD 10.5-11, which is good. In my opinion, they should come down further.

It should come to something around pre-Fukushima level, that was about USD 9.5-10. But in the long-term contracts we are not seeing such similar sharp declining trend. We believe that a similar trend should come. But I think from the capacities that are built up for LNG supply of the world, the availability of LNG and from the demand point of view also I think we should see some declining trend in the prices for long-term and short-term as well.

Q: What are the current long-term trends and how much may they dip?

A: We are negotiating with several potential suppliers for long-term volumes for our enhanced capacity at Dahej, also for Kochi and also considering that our third Gangavaram terminal would come up. The producers generally try to link it with crude oil and they expect somewhere around 14% of the linkage with crude, which in our opinion is still higher. We think that in time to come the long-term prices should also soften.

Q: On the ADB stake what's the progress? GAIL I think has been ruled out. You are in negotiations with Qatar at this point?

A: I am not aware of exactly what the board has said but I think out of the four, three promoter companies have taken review of their decision and have communicated to the ADB that they could go ahead with their stake sale to a strategic partner which should fit into the overall premise and working of the company without changing its character. I am sure GAIL would also do the same thing. It's a matter of discussion and time perhaps.

Q: You are in discussions with Qatar at this point. It would also help you in terms of long-term sourcing. I understand there are some differences over the prices that they are asking. Petronet I believe wants a slightly lower price. Are you in those discussions at this point?

A: As far as ADB’s stake is concerned, we have actually no role to play. It is the ADB which has to negotiate and work out as per the given process. But, we are negotiating with RasGas for long-term supply for quite sometime and we have moved ahead substantially on that.

I think we have been emphasizing on the special characters of the Indian markets which needs to be recognized. It needs to be seen differently than any other market in the Asian region. It's a long-term perspective that needs to be taken for India. We are trying to emphasize on the pricing to RasGas and we are in discussion with them.

Q: What might be the margins this year? Would you see them improve because of the fallen gas prices?

A: I think our major revenues come from regasification charges and the services we provide. Over 90% of our throughput is on the backpack for the regas services, but a very small amount of that comes from this thing. With the spot prices coming down, there is a likelihood of better margins, but all those things again are sold back to back.

I won't say a major difference, but yes, there is a possibility of better margins with the spot cargos which come and which are sold for a small time variation and requirements of the consumer.

Q: Even Marubeni is ending in 2013. What's the current trend looking like for long-term supplies? The people of course are asking for 14% on crude, but do you think it could come down to say 10-11%?

A: I won't really see that 10-11% will be a very good situation for India, but certainly around 12.5-13% would be more realistic considering the prevailing situation in the world in terms of LNG availability and the demand point of view and considering that the larger demand centres are in Asia, India and China.

I think that would be a very realistic price regime and we are proposing that the prices should soften. We also need to be very cautious because of this volatility. When we close these deals I think we will take some more time to really look for little more softening of the prices.

Source: CNBC - TV 18

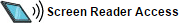

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country