The company has an inbuilt mechanism of 5 percent increase in tariffs every January, which is an already negotiated and agreed number, said Prabhat Singh, MD & CEO, Petronet LNG.

Renegotiation of the LNG pricing formula with Australia's Gorgon project has come as a shot in the arm for Indian companies. This move will ring in savings of ten thousand crores over the life of the contract.

Prabhat Singh, MD & CEO, Petronet LNG said going forward there are no other long-term contracts that are up for renewal. They had long-term contracts with Qatar and Gorgon with whom they were successful in renegotiating the prices.

Talking about the outlook for business going forward he said, as far as long-term contracts are concerned, the company has already tied up back to back with off takers, which are IOC, BPCL and Gail and therefore they are secure in terms of volume picking up is concerned.

Moreover, the company is earning money in terms of utilisation of capacity of the regas terminals, he said, adding that currently their Dahej plant is running at over 100 percent utilisation.

Meanwhile, the company also has an inbuilt mechanism of 5 percent increase in tariffs every January, which is an already negotiated and agreed number, which will further aid the topline, said Singh.

Below is the verbatim transcript of the interview.

Latha: This one renegotiations is over and done with. Are you expecting to renegotiate more long term contracts at lower prices?

A: As far as Petronet is concerned, we had two long-term contracts. One was with Qatar and that we did a year and a half back and this part on the other one is the Gorgon one which as we said that we have been able to come to some agreement which is much more market related and beyond this, Petronet does not have any other long-term contracts as such. There are other companies who have long-term contracts and the question of whether it is going to be talked about and discussed would be more relevant for those companies I would say.

Anuj: So you are saying that this does not benefit you in a material way?

A: No, this particular thing, by and large because the utilisation of the capacity of the terminal something which is prevalent upon the market picking up the material and as of today, when I am talking to you, we are running at the Dahej more than 100 percent capacity so that is something which is the benefit come into the organisation.

Surabhi: Can you help us understand what this will mean for your margins? Obviously, you have renegotiated with Qatar some time back and now Gorgon, so the cost is coming down there. What are you looking at with respect to tariffs? Are tariffs stable? Are you looking at hikes? And therefore, what can we expect for the margins?

A: The point is Petronet, by and large, as far as the long-term contracts are concerned, we have tied up back to back with the off-takers which are Indian Oil Corporation (IOC), Bharat Petroleum Corporation (BPCL) and GAIL and therefore, we are completely secure as far as the contract volume picking up is concerned. But the point I am trying to indicate here is Petronet is earning money in terms of utilisation of the capacity of the regas terminals. And like you have seen in 2015, towards the end it had happened to a certain state because the prices were high and the utilisation of the terminal had gone down by the volumes being picked up from the market in the long-term were less than nearly around 38 percent.

So, that was then affecting our regas terminal capacity utilisation in some manner because obviously it is dependent on the other volumes available in terms of spot and other priced LNG cargoes. So, it in a way affects us because the consumer is not picking up therefore, the off-takers do not pick up, therefore tanked up positions happen, therefore the efficiency of utilisation of the terminal goes down. And as of today, like I am saying, because of these pricing being very conducive and as I am talking to you today, the spot prices are not, at this point of time, I would say nearly USD 7.8-7.75 per MMBTU. So, it is all our long-term contracts are priced lower than that. So we are assured that our long-term volumes are being picked up and the reason as of today, when I am talking to you, my Dahej terminal is operating more than 15 million tonnes which is the capacity of the terminal.

Surabhi: I get your point in terms of the volume benefit that obviously the offtake levels are going to go up simply because of the renegotiation, but in terms of regasification margins, what should one expect? Is there any kind of a tariff change that you are planning with the off-takers? I am talking about the offtake side?

A: Actually, what is happening is that we have an inbuilt mechanism of having a five percent increase every January. So that is going to benefit and it is going to come to us and that is a negotiated agreed number and therefore, we are very happy to run with that number. And even with this 5 percent our tariffs at Dahej are still the cheapest in the country. So therefore, our terminal is going to be used and this extra 5 percent in terms of revenue will definitely start flowing into us next year.

Latha: How are you looking at the global LNG prices? There are people who have been taking advantage of the lower prices globally and not coming back and taking the contracted gas from you. Do you think that period of competition is over because we have begun to see gas prices rising? Therefore, will your margins and volume be better in the current year?

A: One thing let me tell you, there are two aspects to it. For us, since in the long-term contracts, whatever we are doing, we actually take care of, if the pricing is less than the spot and the ongoing rate then our utilisation is better because we are passing through all the benefit in terms of the molecule price to the off-takers. But when you look at the long-term scenario of the global LNG market that to India, is a very favourable position as of today because if you see the whole paradigm or the business model of actually putting in gas molecules into the market has changed.

It has gone away from the biggies or the heavy pocket people into the range or realm of the people who are not so financially very great in the sense that there are middle level people who are so to say middle level investors. They are now into the game so therefore, there are nearly around in the US, there are around some 10,000 people who are actually operating from the backyard. So the molecules which are coming on the platform are not only of say in terms of oil from OPEC, etc. or in terms of gas Chevron, Exxon, etc. there are some Mr Tom, Mr Smith, etc. who are putting their molecules on the platform which is being produced at shoestring budget and today, less than USD 2 worth of gas is being produced in the US which is more than 850 TCF.

So I would say there is a pricing recorrection which is happening today and therefore, for the next decade at least I feel this particular price is going to remain as low as whatever we are expecting even now. Now today, whatever I feel it is a higher price. It is going to go down and come back to around 5 and 6. So if that is the price, to a buyers' market and India this is going to be heaven for the sellers and great time for India.

Latha: What will be the tariff trends that you will see for Petronet LNG in FY18 itself, any increases?

A: Increase is like I said, we are today charging somewhere around Rs 44 which will go by another 5 percent. So, you can take it around Rs 2 something it will be increased. Similarly in Kochi we are charging say around Rs 89-90 or so, and that will also be increased by 5 percent.

Latha: A final industry question, after the fall in gas prices, gas as a fuel for power plants is not a very viable option considering the competition coming from both renewables as well as thermal. Do you see the Indian government coming up with a formula which will make the Indian gas fired power plants viable, if yes, by when?

A: What is happening is that the irony is we have nearly around 25,000 megawatt which is stranded. However, if you really see what happened, a few say 15-20 days back, there was nearly around 2,000 megawatt which went offline from the wind kitty and suddenly we have nearly around 5 million cubic meter of gas more being consumed in the power sector. Now whether it is wind, whether it is solar, the issue of any renewable power is that for it to stablise, for it to be 24/7 available, there has to be a backup available.

Now unless and until there is a stored - what I am trying to say is that there the backup is going to be on some fuel whether it could be coal, it could be diesel, or it could be gas. Now out of these three, with the pricing which is going on today as of now, coal obviously is going to be cheaper, but then from the pollution angle and from everything whatever you are talking about, people are moving away to more environmental friendly fuel. So, if you look at diesel and gas, gas is winning hands down because there is huge arbitrage on that.

Latha: So my short point, when do these plants turn viable?

A: These plants will have to be put into a hybrid situation with the renewables when they come up and therefore supposing as of today whatever is the liquid fuel which is being used in the power, that part will have to be replaced perhaps with a hybrid of solar in the day and in the night you have gas, combined that power cost will be cheaper than that.

Source: http://www.moneycontrol.com/news/business/see-5-tariff-hike-in-jan-aid-topline-no-renewal-contracts-pending-petronet-lng-2398801.html

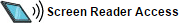

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country