Petronet LNG will diversify into power, city gas

28-Apr-2011Plans 1,200 mw plants at Dahej; to bid for city gas projects either with ONGC or BPCL

Petronet LNG, India's leader in liquefied natural gas (LNG), will diversify into commercial power generation and city gas distribution (CGD).

While a plan hasn't been frozen yet, A K Balyan, managing director and chief operating officer, Petronet LNG, said the diversification process has already been initiated and talks are on with promoters Gail Ltd, Oil and Natural Gas Corporation (ONGC), Indian Oil Corporation and Bharat Petroleum Corporation (BPCL).

"We are planning to set up a 1200 mw power plant at Dahej as we already have certain upsides at the site due to the location of our LNG terminal there," said Balyan, an ONGC veteran, said.

Petronet runs the country's biggest and South-east Asia's first LNG terminal at Dahej with a nameplate capacity of 10 million tonnes per annum (mtpa). It also has access to a robust infrastructure and enjoys certain benefits in the state.

"Since we have a long-term tie up with Qatar, LNG supply is not an issue, there will be no transportation cost and we do not fall under value added tax (VAT), so we have certain competitive advantages as far as power generation is concerned," he said.

While the company has finalised the power capacity of 1200 mw, Balyan said the detailed feasibility report for the project is now ready and a final call will soon be taken on whether to go ahead with small modular plants incrementally adding to the targeted capacity or will it implement the project in one go.

Balyan said city gas will be its second focus area and will look at bidding for projects when the next round of bidding is initiated by the Petroleum and Natural Gas Regulatory Board (PNGRB).

"We are in discussion with two of our promoters — ONGC and BPCL and will soon decide with whom we will partner for a possible foray into CGD," he said.

Power and CGD are two of the three gas-based sectors identified as priority sectors by the government, the third being fertiliser.

While city gas distribution is still evolving, albeit rapidly, power sector has seen massive investments flowing-in in the last couple of years.

An analyst with a leading domestic brokerage firm said that there were two things that attracted several new players into the power sector in the last few years — exorbitant merchant tariffs and ready fuel linkage.

"Now both these factors have lost their sheen — tariffs have come down and linkage is tough to find. In such a case, forward integration makes a lot of sense for Petronet LNG, which has smooth access to raw material," he said. he added that suing gas, the per unit cost of power generation also comes down as compared with coal as feedstock, and this ensures bigger margins for Petronet.

Under the Eleventh Five Year Plan ending in March next, the government had targeted 78,577 mw of capacity addition, but this was later revised down to 64,000 mw.

The massive capacity addition meant several new companies diversifying into power. For the Twelfth Five Year Plan starting April next, the government has set a loftier goal — 100,000 mw capacity addition.

Petronet LNG, India's biggest liquefied natural gas (LNG) player, has beaten market expectations during the quarter ended March 2011 on the back of 100% utilisation of its Dahej terminal. With a 67% year-on-year jump in revenues, 112% year-on-year jump in net profit and 40 trillion British thermal units in re-gassified volume, the company is now on a firm footing. While there are concerns on the viability of its upcoming Kochi terminal, A K Balyan , managing director and CEO, Petronet LNG, in a chat with Promit Mukherjee, said he is confident of tying up customers and sellers for the terminal. Excerpts from the interview:

Your earnings have been pretty good this year. What led to the good numbers?

There are mainly four reasons — first, our volumes have risen considerably in the fourth quarter. We have been able to run our Dahej terminal at 100% capacity which has added to both our topline and bottomline. Second, we have also seen a considerable increase in price, especially in the fourth quarter, because of higher demand for LNG in India and also globally. Third, from January our re-gassification charges have also risen 5% and finally, our internal consumption of gas has been very efficient.

What is the progress on your upcoming terminal in Kochi?

We are moving at a steady speed towards the completion of the Kochi terminal. We plan to have it ready by the third quarter of the next financial year with an enhanced capacity of 5 million tonnes per annum (mtpa). All the required equipment orders have also been placed.

Have you also tied up sources from where you will bring gas for the Kochi terminal?

We are working on that, but have already signed a contract with Exxon Mobil for 1.5 mtpa of LNG from the Gorgon project in Western Australia. We are in talks with Exxon Mobil and Qatar, from where we source LNG for Dahej, for additional supply. However, since the LNG from Gorgon will come by 2013-14, we are looking at short-term supplies and plan to bring in spot cargoes till the time Gorgon LNG is available. We are confident that by the time Kochi is up and running, we will have all 5 mtpa of LNG tied up for sourcing and selling.

You have been planning another LNG terminal in the country. Has something been finalised on that front?

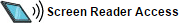

From a long-term perspective, the domestic demand-supply of gas will be highly skewed towards a deficit situation and hence there will be a higher demand for LNG. Considering the pipeline network in place, we see a lot of demand coming from new areas and markets in the east coast. This has led us to believe that there is a need for an additional LNG terminal somewhere around the east coast. We have appointed a consultant and in a month's time the preliminary report will be out. Then we will take a call. But one important thing is that the terminal should be planned along the east coast where there is sufficient marine capacity.

How are the current LNG prices globally?

From a short-term perspective, LNG prices have been victim of high volatility and geographical disturbance. Japan is one of the biggest importers of LNG and with crisis engulfing that country, going forward there will be a high demand of LNG from Japan. This will affect the prices on a year-on-year basis, which may rise beyond $13-14 per mmBtu (million metric British thermal units). Japan will buy more spot cargoes and the demand from Japan is expected to move beyond 6-8 mtpa. But from the long-term perspective, the prices will remain stable as more LNG terminals are coming up and even in India the gas supply situation will ease too. So there will be not much impact on prices.

Will you be a direct beneficiary of the low output from the KG D6 block and the falling levels of Panna Mukta Tapti fields?

One of the reasons we did well in the fourth quarter is that the domestic supply of gas was not up to the mark and hence there was more demand for LNG. Since government has identified power and fertiliser as priority sectors and plants have already been switched to gas, these companies will need LNG if domestic gas is not available. About 65% of the gas in the country is consumed by these two sectors and this number will remain the same going forward, if not grow. We will continue to suffice the demand of these players.

What kind of volumes are you looking at this fiscal?

Last quarter we were able to run our Dahej terminal at 100% capacity. Our target for this year will be to run it at full 10 mtpa capacity.

Considering the demand for LNG in India, are you also looking at increasing the Dahej capacity beyond 10 mtpa?

We will examine the market closely as there is a possibility of increasing its capacity further. The demand in the western region is good. We have been discussing the issue but nothing has been finalised so far.

What is your capex for the current year and are there any fundraising plans?

Our capex for the current year is Rs 1,800 crore, majority of which has been earmarked for the Kochi terminal. Also, we will need roughly Rs.100 crore for our operational expenditure. We have recently awarded job for the construction of the second jetty at Dahej, besides, there could be some more funding requirement if we go ahead with our power venture. So we will have to go ahead with some fundraising, but how much and through which route that has not been decide.

Petronet LNG, India's leader in liquefied natural gas (LNG), will diversify into commercial power generation and city gas distribution (CGD).

While a plan hasn't been frozen yet, A K Balyan, managing director and chief operating officer, Petronet LNG, said the diversification process has already been initiated and talks are on with promoters Gail Ltd, Oil and Natural Gas Corporation (ONGC), Indian Oil Corporation and Bharat Petroleum Corporation (BPCL).

"We are planning to set up a 1200 mw power plant at Dahej as we already have certain upsides at the site due to the location of our LNG terminal there," said Balyan, an ONGC veteran, said.

Petronet runs the country's biggest and South-east Asia's first LNG terminal at Dahej with a nameplate capacity of 10 million tonnes per annum (mtpa). It also has access to a robust infrastructure and enjoys certain benefits in the state.

"Since we have a long-term tie up with Qatar, LNG supply is not an issue, there will be no transportation cost and we do not fall under value added tax (VAT), so we have certain competitive advantages as far as power generation is concerned," he said.

While the company has finalised the power capacity of 1200 mw, Balyan said the detailed feasibility report for the project is now ready and a final call will soon be taken on whether to go ahead with small modular plants incrementally adding to the targeted capacity or will it implement the project in one go.

Balyan said city gas will be its second focus area and will look at bidding for projects when the next round of bidding is initiated by the Petroleum and Natural Gas Regulatory Board (PNGRB).

"We are in discussion with two of our promoters — ONGC and BPCL and will soon decide with whom we will partner for a possible foray into CGD," he said.

Power and CGD are two of the three gas-based sectors identified as priority sectors by the government, the third being fertiliser.

While city gas distribution is still evolving, albeit rapidly, power sector has seen massive investments flowing-in in the last couple of years.

An analyst with a leading domestic brokerage firm said that there were two things that attracted several new players into the power sector in the last few years — exorbitant merchant tariffs and ready fuel linkage.

"Now both these factors have lost their sheen — tariffs have come down and linkage is tough to find. In such a case, forward integration makes a lot of sense for Petronet LNG, which has smooth access to raw material," he said. he added that suing gas, the per unit cost of power generation also comes down as compared with coal as feedstock, and this ensures bigger margins for Petronet.

Under the Eleventh Five Year Plan ending in March next, the government had targeted 78,577 mw of capacity addition, but this was later revised down to 64,000 mw.

The massive capacity addition meant several new companies diversifying into power. For the Twelfth Five Year Plan starting April next, the government has set a loftier goal — 100,000 mw capacity addition.

Petronet LNG, India's biggest liquefied natural gas (LNG) player, has beaten market expectations during the quarter ended March 2011 on the back of 100% utilisation of its Dahej terminal. With a 67% year-on-year jump in revenues, 112% year-on-year jump in net profit and 40 trillion British thermal units in re-gassified volume, the company is now on a firm footing. While there are concerns on the viability of its upcoming Kochi terminal, A K Balyan , managing director and CEO, Petronet LNG, in a chat with Promit Mukherjee, said he is confident of tying up customers and sellers for the terminal. Excerpts from the interview:

Your earnings have been pretty good this year. What led to the good numbers?

There are mainly four reasons — first, our volumes have risen considerably in the fourth quarter. We have been able to run our Dahej terminal at 100% capacity which has added to both our topline and bottomline. Second, we have also seen a considerable increase in price, especially in the fourth quarter, because of higher demand for LNG in India and also globally. Third, from January our re-gassification charges have also risen 5% and finally, our internal consumption of gas has been very efficient.

What is the progress on your upcoming terminal in Kochi?

We are moving at a steady speed towards the completion of the Kochi terminal. We plan to have it ready by the third quarter of the next financial year with an enhanced capacity of 5 million tonnes per annum (mtpa). All the required equipment orders have also been placed.

Have you also tied up sources from where you will bring gas for the Kochi terminal?

We are working on that, but have already signed a contract with Exxon Mobil for 1.5 mtpa of LNG from the Gorgon project in Western Australia. We are in talks with Exxon Mobil and Qatar, from where we source LNG for Dahej, for additional supply. However, since the LNG from Gorgon will come by 2013-14, we are looking at short-term supplies and plan to bring in spot cargoes till the time Gorgon LNG is available. We are confident that by the time Kochi is up and running, we will have all 5 mtpa of LNG tied up for sourcing and selling.

You have been planning another LNG terminal in the country. Has something been finalised on that front?

From a long-term perspective, the domestic demand-supply of gas will be highly skewed towards a deficit situation and hence there will be a higher demand for LNG. Considering the pipeline network in place, we see a lot of demand coming from new areas and markets in the east coast. This has led us to believe that there is a need for an additional LNG terminal somewhere around the east coast. We have appointed a consultant and in a month's time the preliminary report will be out. Then we will take a call. But one important thing is that the terminal should be planned along the east coast where there is sufficient marine capacity.

How are the current LNG prices globally?

From a short-term perspective, LNG prices have been victim of high volatility and geographical disturbance. Japan is one of the biggest importers of LNG and with crisis engulfing that country, going forward there will be a high demand of LNG from Japan. This will affect the prices on a year-on-year basis, which may rise beyond $13-14 per mmBtu (million metric British thermal units). Japan will buy more spot cargoes and the demand from Japan is expected to move beyond 6-8 mtpa. But from the long-term perspective, the prices will remain stable as more LNG terminals are coming up and even in India the gas supply situation will ease too. So there will be not much impact on prices.

Will you be a direct beneficiary of the low output from the KG D6 block and the falling levels of Panna Mukta Tapti fields?

One of the reasons we did well in the fourth quarter is that the domestic supply of gas was not up to the mark and hence there was more demand for LNG. Since government has identified power and fertiliser as priority sectors and plants have already been switched to gas, these companies will need LNG if domestic gas is not available. About 65% of the gas in the country is consumed by these two sectors and this number will remain the same going forward, if not grow. We will continue to suffice the demand of these players.

What kind of volumes are you looking at this fiscal?

Last quarter we were able to run our Dahej terminal at 100% capacity. Our target for this year will be to run it at full 10 mtpa capacity.

Considering the demand for LNG in India, are you also looking at increasing the Dahej capacity beyond 10 mtpa?

We will examine the market closely as there is a possibility of increasing its capacity further. The demand in the western region is good. We have been discussing the issue but nothing has been finalised so far.

What is your capex for the current year and are there any fundraising plans?

Our capex for the current year is Rs 1,800 crore, majority of which has been earmarked for the Kochi terminal. Also, we will need roughly Rs.100 crore for our operational expenditure. We have recently awarded job for the construction of the second jetty at Dahej, besides, there could be some more funding requirement if we go ahead with our power venture. So we will have to go ahead with some fundraising, but how much and through which route that has not been decide.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country