FY12 output at 11m tonne; may rise in FY13: Petronet LNG

9-Dec-2011RK Garg, Director (Finance) Petronet LNG tells CNBC-TV18 that he is happy with the deal that LNG has got with GDF (GAZ de France) at 13-14% of crude price. ďSupply is likely to start in 2012,Ē he says. Garg sees spot prices softening for crude.

Q: There are some rumors in the market that the Petroleum and Natural Gas Regulatory Board (PNGRB) has actually initiated discussions to put a control on marketing margins. Have you heard anything in this regard?

A: No, I donít think so. As per the adjusting regulation of PNGRB, they have the right to register the RLNG terminal, but as far as the regulation of that part is not there, it is not happening. We had neither received any communication nor has there been any information with us that there is anything happening on that account.

Q: What would your marketing margin be?

A: Basically, we are doing the regasification for long-term cargo, and the regasification charge is a likely charge as per the contract. In addition to that, when we bring away spot cargos, those spot cargos depend on a particular market situation, and accordingly, small marketing margins are added. Since we take a call at that particular time based on risk at that time, these are not very big margins. However, since there is a spot deal, and depending upon where we are buying and where we sell, we have small margin on that.

Q: Whatís your sense on pricing? You recently signed a deal with GAZ de France (GDF) at 13-14% of crude. The recent deal at Taiwan and Qatargas happened at 15%. You have had a lot of spot cargos selling at 17 per mmbtu. What do you think is the pricing trajectory for LNG?

A: There are different markets for different kind of cargo. If you are buying spot cargo, the spot prices are applicable at that particular point of time, and when we deal for a short-term cargo, like you have mentioned for GDF, yes, of course we had a good deal. Supply will be coming in 2012; itís a very good deal in this current market.

Yes, of course, these LNG suppliers are looking for prices linked with crude, and those are ranging between 14-15%. So there are different prices, but we have seen over the last few days that the spot market is softening up. We are hopeful that maybe we will be able to get some better deal in future.

Q: What kind of volumes are you expecting to do in second half of FY12, but more importantly FY13?

A: We are operating currently in more than 100% of capacity. In fact, last November, we even touched 105-108%. There is a limitation up to which we can stretch ourselves and we canít go beyond this. Yes, we are bringing our second LNG jetty, which is likely to be commissioned sometime in October 2013, then there is a possibility that we will increase our output from our existing terminal probably by 12-12.5 million tonne. Currently, we canít go beyond 11 million tonne.

Q: Whatís your expectation on total volumes in the 3rd quarter? How may spot cargos have you already done and would you be looking at a capacity utilization of somewhere around 110% this time?

A: We will be definitely doing the capacity at the same level as we have done in the first half. I think we will operate at this level, maybe a little bit better. The market is good and we have already tied up the cargos for the next half year. As far as capacity is concerned, if our input and the output remain quite constant, then we can do better, but the market conditions actually work differently. We are hopeful that we will be able to manage our output very close to what we have done in the first half and better hopefully.

Q: You are sitting on a decent amount of cash. Will you want to lower debt or for that matter plan more expansions?

A: Actually, we have lowered the debt. We have done early repayment of Rs 500 crore to our inland lender last month. Yes, of course there is a possibility.

Q: So whatís the debt now?

A: Our debts are quite low. The Debt-equity ratio is more or less 1:1. So we are very comfortable.

Q: Any word on the possibly the Gaz-prom deal? Any deals in the works that you would be signing soon?

A: Yes, we are discussing. Actually, a long-term deal generally takes a longer time, and the Gaz-prom in any case, they are going to supply from their new facility which they are creating. So supply would commence sometime in 2016-2017, so we have plenty of time. This Memorandum of Understanding (MOU) was signed nearly six months ago and now we are in discussion with them with respect to specific terms and conditions, so matter is moving positively. And of course, we will continue to raise certain rates as the market would need more gas and we are ready with our capacity.

Source: http://www.moneycontrol.com/news/business/fy12outputat11mtonne;mayrisefy_631454.html

Video Link: http://www.moneycontrol.com/video/business/fy12-output-at-11m-tonne-may-risefy13-petronet-lng_631454.html?utm_source=Article_Vid

Q: There are some rumors in the market that the Petroleum and Natural Gas Regulatory Board (PNGRB) has actually initiated discussions to put a control on marketing margins. Have you heard anything in this regard?

A: No, I donít think so. As per the adjusting regulation of PNGRB, they have the right to register the RLNG terminal, but as far as the regulation of that part is not there, it is not happening. We had neither received any communication nor has there been any information with us that there is anything happening on that account.

Q: What would your marketing margin be?

A: Basically, we are doing the regasification for long-term cargo, and the regasification charge is a likely charge as per the contract. In addition to that, when we bring away spot cargos, those spot cargos depend on a particular market situation, and accordingly, small marketing margins are added. Since we take a call at that particular time based on risk at that time, these are not very big margins. However, since there is a spot deal, and depending upon where we are buying and where we sell, we have small margin on that.

Q: Whatís your sense on pricing? You recently signed a deal with GAZ de France (GDF) at 13-14% of crude. The recent deal at Taiwan and Qatargas happened at 15%. You have had a lot of spot cargos selling at 17 per mmbtu. What do you think is the pricing trajectory for LNG?

A: There are different markets for different kind of cargo. If you are buying spot cargo, the spot prices are applicable at that particular point of time, and when we deal for a short-term cargo, like you have mentioned for GDF, yes, of course we had a good deal. Supply will be coming in 2012; itís a very good deal in this current market.

Yes, of course, these LNG suppliers are looking for prices linked with crude, and those are ranging between 14-15%. So there are different prices, but we have seen over the last few days that the spot market is softening up. We are hopeful that maybe we will be able to get some better deal in future.

Q: What kind of volumes are you expecting to do in second half of FY12, but more importantly FY13?

A: We are operating currently in more than 100% of capacity. In fact, last November, we even touched 105-108%. There is a limitation up to which we can stretch ourselves and we canít go beyond this. Yes, we are bringing our second LNG jetty, which is likely to be commissioned sometime in October 2013, then there is a possibility that we will increase our output from our existing terminal probably by 12-12.5 million tonne. Currently, we canít go beyond 11 million tonne.

Q: Whatís your expectation on total volumes in the 3rd quarter? How may spot cargos have you already done and would you be looking at a capacity utilization of somewhere around 110% this time?

A: We will be definitely doing the capacity at the same level as we have done in the first half. I think we will operate at this level, maybe a little bit better. The market is good and we have already tied up the cargos for the next half year. As far as capacity is concerned, if our input and the output remain quite constant, then we can do better, but the market conditions actually work differently. We are hopeful that we will be able to manage our output very close to what we have done in the first half and better hopefully.

Q: You are sitting on a decent amount of cash. Will you want to lower debt or for that matter plan more expansions?

A: Actually, we have lowered the debt. We have done early repayment of Rs 500 crore to our inland lender last month. Yes, of course there is a possibility.

Q: So whatís the debt now?

A: Our debts are quite low. The Debt-equity ratio is more or less 1:1. So we are very comfortable.

Q: Any word on the possibly the Gaz-prom deal? Any deals in the works that you would be signing soon?

A: Yes, we are discussing. Actually, a long-term deal generally takes a longer time, and the Gaz-prom in any case, they are going to supply from their new facility which they are creating. So supply would commence sometime in 2016-2017, so we have plenty of time. This Memorandum of Understanding (MOU) was signed nearly six months ago and now we are in discussion with them with respect to specific terms and conditions, so matter is moving positively. And of course, we will continue to raise certain rates as the market would need more gas and we are ready with our capacity.

Source: http://www.moneycontrol.com/news/business/fy12outputat11mtonne;mayrisefy_631454.html

Video Link: http://www.moneycontrol.com/video/business/fy12-output-at-11m-tonne-may-risefy13-petronet-lng_631454.html?utm_source=Article_Vid

Source: CNBC-TV18

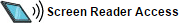

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country