Soft LNG prices, govt steps aiding offtake: Petronet LNG

30-Jun-2015Speaking about volumes, RK Garg, director-finance at Petronet LNG said Dahej and Kochi terminals need to improve its operating capacity to see uptick in volumes.

Petronet LNG has seen improvement in offtake in the current quarter due to soft LNG prices and positive government steps. Speaking about volumes, RK Garg, director-finance at said Dahej and Kochi terminals need to improve its operating capacity to see uptick in volumes.

The Dahej expansion is expected to be completed by this year end. Sixty percent of work is already finished. However, the Kochi project will take more time, Garg said.

"Kochi the main issue that we are facing is connectivity with the major consuming sector, which was supposed to be in place when our plants got ready last year. There have been issues with laying the pipeline," he said.

Currently, the company is using Kochi for storing energy and reloading services to mitigate its losses. Garg said the new terminals will take atleast three years to become functional, but the offtake will improve with low low LNG prices, which are favorable for the consumers.

Below is the transcript of RK Garg's interview on CNBC-TV18.

CNBC-TV18: Last quarter was not very happy for you. It was a dismal quarter to say the least. Is there any improvement in the current quarter in terms of offtake?

A: There has been improvement in the last month. The offtake has increased primarily because of two reasons. Firstly, spot LNG prices are low and customers are taking advantage. Secondly, the government initiative with respect to offtake in power sector because of the stranded powers policy which has brought by government and was put on for implementation from June 1 has helped in offtaking more quantity. We have seen that there is improvement as compared to the last quarter.

CNBC-TV18: You said it is primarily because of the spot prices are low. I thought you have a problem because spot prices are low - isn't that unfavourable to your longer-term contracts?

A: You see there are two things. We should not compare the prices prevailing in the spot market and prices as per the long term contracts. Long term contract and pricing is valid for a long term.

In our case, we have a contract for 25 years. We have been enjoying the better pricing in long-term for the last 11 years. There was a steep decline in the crude oil prices that has impacted LNG prices. This is the phenomenon that will improve over a period of time. Where the spot market goes with the spot conditions in the market and where the LNG prices currently is very soft and favorable to the consumers. The long term prices are also dropping every month, but it will take time to align it with the market.

CNBC-TV18: Can I go ahead and assume that offtake will not contract in this Q1?

A: I am not telling that because contracts works on annual delivery program and so we have just finished only one quarter last time. We are working in the current year and we are in discussion with the offtakers how to improve the offtakes and all this context have the take or pay provisions. It means that if the offtake is less, then there is a liability towards the take or pay. Everybody understands that and we are trying to work out a situation where we could mitigate this take or pay situation if it happens.

CNBC-TV18: Can you give us a status check on the capacity expansion at Dahej?

A: The Dahej expansion is doing very well and it is exactly on schedule. We will be completing that expansion by the end of 2016. We have already completed 60 percent of the physical progress and things are going as planned. We have no concern with expansion of the Dahej terminal.

CNBC-TV18: More important is Kochi because that has remained a drag up until last year because of the pipeline. Any improvement there?

A: Kochi would take time. In Kochi, the main issue that we are facing is the connectivity with the major consuming sector and it was supposed to be in place when our plants got ready last year. There have been issues with laying the pipeline, GAIL is facing some resistance.

Off late, there has been a positive indication especially in the state of Kerala. The state government is willing to support laying off pipeline and Gail, along with the state government, is working to make it happen. Once the pipeline is in place, we have no doubt that Kochi would also be a terminal that should also operate as Dahej, but it will take time.

Kochi, we are using for other purposes as of now. We are using it for bringing LNG and storing that, reloading and other services, which is giving a reasonable revenue atleast to mitigate the losses at there as of now.

CNBC-TV18: Can you help us with any outlook on your volumes in spot margins for FY16 as well as next year?

A: Volume-wise, we have no doubt because we the regasification capacity in the country is virtually very limited. Kochi is not operating because of pipeline issue. Dahej and other terminal, which is in Gujarat owned by Shell and Total at Hazira, are the two operating terminal for 12 months in a year.

Dabhol is also operating but it operates only few months and during monsoon period it doesn't operate, like as of now it is not operating. So that constraint would remain and we are seeing that new terminals, which are likely to come, will take at least 3 years from now. The demand in the country is definitely improving and spot prices are comparatively better in favour of the consumers. We will definitely see the growth and are wise to take this growth and improve our capacity. We look it as a very positive sign.

CNBC-TV18: Is there any risk to the regasification charges? If the take or pay contracts are revoked by the people, who are buying the gas?

A: For us, if the take over pay is invoked, it is also the take or pay to the offtakers. And take over pay offtakers when it is going to the offtakers, it includes the regasification change also. We don't foresee any risk on that account. Currently, our plant utilization is better because of the power sector has come in and there is definitely demand in the country for buying more and more spot LNG.

Petronet LNG has seen improvement in offtake in the current quarter due to soft LNG prices and positive government steps. Speaking about volumes, RK Garg, director-finance at said Dahej and Kochi terminals need to improve its operating capacity to see uptick in volumes.

The Dahej expansion is expected to be completed by this year end. Sixty percent of work is already finished. However, the Kochi project will take more time, Garg said.

"Kochi the main issue that we are facing is connectivity with the major consuming sector, which was supposed to be in place when our plants got ready last year. There have been issues with laying the pipeline," he said.

Currently, the company is using Kochi for storing energy and reloading services to mitigate its losses. Garg said the new terminals will take atleast three years to become functional, but the offtake will improve with low low LNG prices, which are favorable for the consumers.

Below is the transcript of RK Garg's interview on CNBC-TV18.

CNBC-TV18: Last quarter was not very happy for you. It was a dismal quarter to say the least. Is there any improvement in the current quarter in terms of offtake?

A: There has been improvement in the last month. The offtake has increased primarily because of two reasons. Firstly, spot LNG prices are low and customers are taking advantage. Secondly, the government initiative with respect to offtake in power sector because of the stranded powers policy which has brought by government and was put on for implementation from June 1 has helped in offtaking more quantity. We have seen that there is improvement as compared to the last quarter.

CNBC-TV18: You said it is primarily because of the spot prices are low. I thought you have a problem because spot prices are low - isn't that unfavourable to your longer-term contracts?

A: You see there are two things. We should not compare the prices prevailing in the spot market and prices as per the long term contracts. Long term contract and pricing is valid for a long term.

In our case, we have a contract for 25 years. We have been enjoying the better pricing in long-term for the last 11 years. There was a steep decline in the crude oil prices that has impacted LNG prices. This is the phenomenon that will improve over a period of time. Where the spot market goes with the spot conditions in the market and where the LNG prices currently is very soft and favorable to the consumers. The long term prices are also dropping every month, but it will take time to align it with the market.

CNBC-TV18: Can I go ahead and assume that offtake will not contract in this Q1?

A: I am not telling that because contracts works on annual delivery program and so we have just finished only one quarter last time. We are working in the current year and we are in discussion with the offtakers how to improve the offtakes and all this context have the take or pay provisions. It means that if the offtake is less, then there is a liability towards the take or pay. Everybody understands that and we are trying to work out a situation where we could mitigate this take or pay situation if it happens.

CNBC-TV18: Can you give us a status check on the capacity expansion at Dahej?

A: The Dahej expansion is doing very well and it is exactly on schedule. We will be completing that expansion by the end of 2016. We have already completed 60 percent of the physical progress and things are going as planned. We have no concern with expansion of the Dahej terminal.

CNBC-TV18: More important is Kochi because that has remained a drag up until last year because of the pipeline. Any improvement there?

A: Kochi would take time. In Kochi, the main issue that we are facing is the connectivity with the major consuming sector and it was supposed to be in place when our plants got ready last year. There have been issues with laying the pipeline, GAIL is facing some resistance.

Off late, there has been a positive indication especially in the state of Kerala. The state government is willing to support laying off pipeline and Gail, along with the state government, is working to make it happen. Once the pipeline is in place, we have no doubt that Kochi would also be a terminal that should also operate as Dahej, but it will take time.

Kochi, we are using for other purposes as of now. We are using it for bringing LNG and storing that, reloading and other services, which is giving a reasonable revenue atleast to mitigate the losses at there as of now.

CNBC-TV18: Can you help us with any outlook on your volumes in spot margins for FY16 as well as next year?

A: Volume-wise, we have no doubt because we the regasification capacity in the country is virtually very limited. Kochi is not operating because of pipeline issue. Dahej and other terminal, which is in Gujarat owned by Shell and Total at Hazira, are the two operating terminal for 12 months in a year.

Dabhol is also operating but it operates only few months and during monsoon period it doesn't operate, like as of now it is not operating. So that constraint would remain and we are seeing that new terminals, which are likely to come, will take at least 3 years from now. The demand in the country is definitely improving and spot prices are comparatively better in favour of the consumers. We will definitely see the growth and are wise to take this growth and improve our capacity. We look it as a very positive sign.

CNBC-TV18: Is there any risk to the regasification charges? If the take or pay contracts are revoked by the people, who are buying the gas?

A: For us, if the take over pay is invoked, it is also the take or pay to the offtakers. And take over pay offtakers when it is going to the offtakers, it includes the regasification change also. We don't foresee any risk on that account. Currently, our plant utilization is better because of the power sector has come in and there is definitely demand in the country for buying more and more spot LNG.

Source: CNBC-TV18

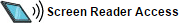

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country