Capacity utilisation at Dahej on expected lines: Petronet

8-Sep-2015Speaking to CNBC-TV18, RK Garg, Acting MD & CEO of Petronet LNG said there has been a shortfall in offtake due to unprecedented fall in prices. Long-term prices have fallen by 30 percent in Q1 and Garg says the company is trying to make up the "drop" by buying spot volume from the "attractive" spot market. He says the company's Dahej terminal is operating very well and the capacity utilisation is as per expectations. Â Below is the transcript of RK Garg's interview with Latha Venkatesh and Sonia Shenoy on CNBC-TV18.

Sonia: Can you confirm for us whether or not Petronet has postponed this 30 percent of the long-term contracted gas from Rasgas and if you have that trigger that take opaque laws where you have to make any kind of advance payment?

A: As per the long-term arrangement we have, which is a 25 years contract signed by Petronet with the upstream and downstream suppliers for supplying of gas to the offtakers, there are contractual provisions and these contractual commitments have to be honoured by each party, which has committed for it. We have seen unprecedented crude fall during last one year and because of that reason, there has been an issue of high price under the existing contract and we have reported in our last quarter that there has been a shortfall in offtake, around 30 percent, because of the high prices.

As of now the similar level is continuing and there is a provision for take or pay, if that happens —take or pay liability is to be known at the end of the calendar year  — then both parties have to honour their commitments with respect to contractual arrangements.

Latha: Typically how long are your price contracts, do you have these contracts for 5-years, for 20-years or are the quantum for longer-term but the price is more a rolling three-year average or a five-year average?

A: All this pricing formulas and everything under the context are of a confidential nature and I will not be able to share much.

Latha: I am just asking you on an average are these 10-year average prices or 5-year average prices, how long have you to wait before you can see your averages long-term contracts pricing coming down?

A: Because of a sudden drop, this has impacted because this is a 5-year average and that is going to again get that one test maybe in the later part of the year.

This is a 25-year contract and that we had seen in earlier years, the company and the country has gained because of the low prices and advantage under the same contract and this is a sudden impact which has happened and I think this is going to be taken care of in the near future.

Latha: How near is that future? FY17?

A: Could be FY17-FY18 depends upon how crude behaves.

Sonia: What is the percentage of contracted gas that you have sourced from RasGas so far in the first two quarters of the year?

A: We have mentioned that in Q1 around 30 percent drop was there but we could make up that drop through buying spot volume from the spot market and this is currently -- we have seen the spot market is very attractive and we are providing the regional volume to the consumer buying from the spot market.

Latha: What is the percentage of term contracts and percentage of spot cargos that you normally buy, what percentage of your sales?

A: We have around 7.5 million tonne contract, which is a long-term contract and our capacity of Dahej terminal is 10 million tonne. So virtually we can say that around 25 percent is buying spot or tolling arrangement but because of drop in the long-term volumes, we are making up buying the spot volumes from the market and supplying to the consumers. So capacity is fully used to that extent.

Sonia: You mentioned that you will have to fulfill the obligations of the take or pay clause as and when it comes through. But what could the ballpark amount be of the advanced payment? Some reports suggest that there could be a potential impact of around Rs 9,000 crore. Is that very high estimate, what are the numbers that we are looking at as far as the advanced payment is concerned?

A: I will not give you numbers at this stage because still have five months to take care of the situation and all parties know about it. We are working to mitigate the situation, which we perceive is likely to happen. Let us see and wait before giving any numbers.

Latha: Normally how are these contracts -- you have a take or pay with RasGas and the people you supply to also you have a take or pay with them?

A: They are materially back to back contracts.

Latha: So you don’t bear any of the pricing risk?

A: No, there is no pricing risk, there is no volume risk. So as far as Petronet is concerned, these contracts are materially back to back.

Sonia: Can you tell us what the expectation is for your own business going ahead in the next couple of quarters because in Q1, your margins were hit quite a bit, what is the expectation in Q2 and Q3?

A: The market of natural gas as far as the demand is concerned is good and we have the advantage of the softening in prices especially in spot market, we have seen the prices are dropping close to USD 7-8 per mmbtu and this has helped certain consumers and some of the initiatives taken by the government especially in the power and fertiliser sector by pulling the prices of domestic as well as imported gas in fertiliser sector and power sector for a stranded power where the regasified liquefied natural gas (RLNG) is getting used in power sector to some extent. This has helped in increasing the demand in the country and also helped the company in using our capacity to the maximum. I think that would continue in future.

Sonia: Would your EBITDA runrate be Rs 350 crore or would you do much better?

A: I will not venture out in giving numbers again. You have to see the numbers the way it will come but I think our Dahej terminal is operating very well and the capacity utilisation is as per our expectations.

Read more at: http://www.moneycontrol.com/news/business/capacity-utilisation-at-dahejexpected-lines-petronet_2961001.html?utm_source=ref_article

Sonia: Can you confirm for us whether or not Petronet has postponed this 30 percent of the long-term contracted gas from Rasgas and if you have that trigger that take opaque laws where you have to make any kind of advance payment?

A: As per the long-term arrangement we have, which is a 25 years contract signed by Petronet with the upstream and downstream suppliers for supplying of gas to the offtakers, there are contractual provisions and these contractual commitments have to be honoured by each party, which has committed for it. We have seen unprecedented crude fall during last one year and because of that reason, there has been an issue of high price under the existing contract and we have reported in our last quarter that there has been a shortfall in offtake, around 30 percent, because of the high prices.

As of now the similar level is continuing and there is a provision for take or pay, if that happens —take or pay liability is to be known at the end of the calendar year  — then both parties have to honour their commitments with respect to contractual arrangements.

Latha: Typically how long are your price contracts, do you have these contracts for 5-years, for 20-years or are the quantum for longer-term but the price is more a rolling three-year average or a five-year average?

A: All this pricing formulas and everything under the context are of a confidential nature and I will not be able to share much.

Latha: I am just asking you on an average are these 10-year average prices or 5-year average prices, how long have you to wait before you can see your averages long-term contracts pricing coming down?

A: Because of a sudden drop, this has impacted because this is a 5-year average and that is going to again get that one test maybe in the later part of the year.

This is a 25-year contract and that we had seen in earlier years, the company and the country has gained because of the low prices and advantage under the same contract and this is a sudden impact which has happened and I think this is going to be taken care of in the near future.

Latha: How near is that future? FY17?

A: Could be FY17-FY18 depends upon how crude behaves.

Sonia: What is the percentage of contracted gas that you have sourced from RasGas so far in the first two quarters of the year?

A: We have mentioned that in Q1 around 30 percent drop was there but we could make up that drop through buying spot volume from the spot market and this is currently -- we have seen the spot market is very attractive and we are providing the regional volume to the consumer buying from the spot market.

Latha: What is the percentage of term contracts and percentage of spot cargos that you normally buy, what percentage of your sales?

A: We have around 7.5 million tonne contract, which is a long-term contract and our capacity of Dahej terminal is 10 million tonne. So virtually we can say that around 25 percent is buying spot or tolling arrangement but because of drop in the long-term volumes, we are making up buying the spot volumes from the market and supplying to the consumers. So capacity is fully used to that extent.

Sonia: You mentioned that you will have to fulfill the obligations of the take or pay clause as and when it comes through. But what could the ballpark amount be of the advanced payment? Some reports suggest that there could be a potential impact of around Rs 9,000 crore. Is that very high estimate, what are the numbers that we are looking at as far as the advanced payment is concerned?

A: I will not give you numbers at this stage because still have five months to take care of the situation and all parties know about it. We are working to mitigate the situation, which we perceive is likely to happen. Let us see and wait before giving any numbers.

Latha: Normally how are these contracts -- you have a take or pay with RasGas and the people you supply to also you have a take or pay with them?

A: They are materially back to back contracts.

Latha: So you don’t bear any of the pricing risk?

A: No, there is no pricing risk, there is no volume risk. So as far as Petronet is concerned, these contracts are materially back to back.

Sonia: Can you tell us what the expectation is for your own business going ahead in the next couple of quarters because in Q1, your margins were hit quite a bit, what is the expectation in Q2 and Q3?

A: The market of natural gas as far as the demand is concerned is good and we have the advantage of the softening in prices especially in spot market, we have seen the prices are dropping close to USD 7-8 per mmbtu and this has helped certain consumers and some of the initiatives taken by the government especially in the power and fertiliser sector by pulling the prices of domestic as well as imported gas in fertiliser sector and power sector for a stranded power where the regasified liquefied natural gas (RLNG) is getting used in power sector to some extent. This has helped in increasing the demand in the country and also helped the company in using our capacity to the maximum. I think that would continue in future.

Sonia: Would your EBITDA runrate be Rs 350 crore or would you do much better?

A: I will not venture out in giving numbers again. You have to see the numbers the way it will come but I think our Dahej terminal is operating very well and the capacity utilisation is as per our expectations.

Read more at: http://www.moneycontrol.com/news/business/capacity-utilisation-at-dahejexpected-lines-petronet_2961001.html?utm_source=ref_article

Source: CNBC-TV18

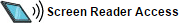

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country